Being a human isn’t cheap. Food, clothes, rent, healthcare, education—it all adds up quickly.

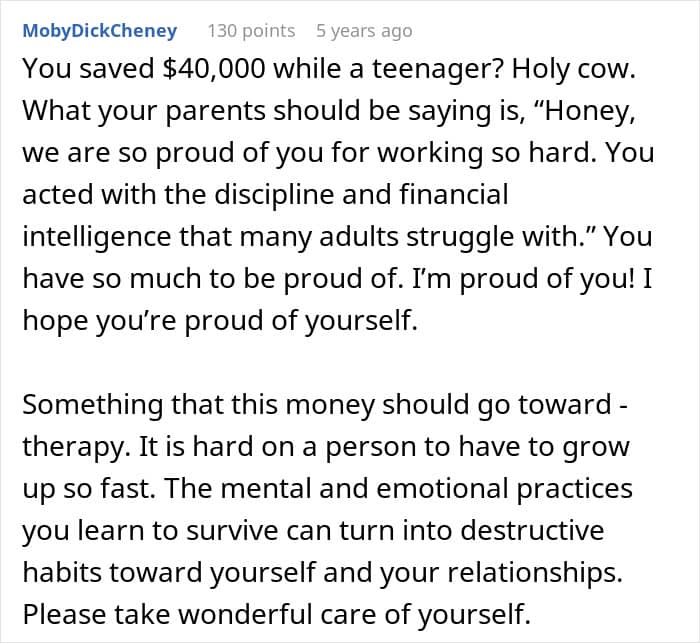

One Redditor knew this early on and decided to prepare for her future. She started working at 14, juggling jobs until she managed to save $40K by the age of 19 to pay for college. But instead of celebrating her determination, her parents stunned her with a demand: they wanted every penny, claiming she owed them the money for raising her.

Unsure if she was in the wrong for refusing, she turned to the internet for advice. Here’s her story.

RELATED:The young woman had been working since she was 14, saving $40K to pay for college

But to her shock, her parents demanded every penny, claiming it was payment for raising her

Should kids financially support their parents?

Becoming a parent is no small task. It’s physically and emotionally demanding, and let’s face it, raising kids comes with a hefty price tag.

In the US, for example, research from 2022 estimated that a middle-income family with two children could expect to spend around $310,605 (adjusted for higher future inflation) to raise just one child born in 2015 through age 17.

A more recent study put the average annual cost of raising a child at $21,681—a 19% jump from 2016—bringing the total estimated cost to about $389,000 over 18 years.

But does that mean kids are somehow obligated to return the favor once they grow up?

Not necessarily to the extreme of handing over their entire life savings, as the teen in the story above was pressured to do, but in many families, contributing financially is seen as normal. In some cultures, it’s even expected.

Take Ukraine, where I’m from. It’s common to give your first paycheck to your parents as a gesture of thanks for all their efforts raising you.

In other parts of the world, especially in more collectivist societies like China, India, and across East and South Asia, supporting parents financially is often considered a moral duty, deeply tied to values of respect and reciprocity.

For example, Nicole Xie, a Chinese immigrant in Australia, told ABC News in 2017 that she regularly sent hundreds of dollars from her salary back home. At the time, she was transferring $600 a fortnight to cover her parents’ utility bills, council rates, and other expenses.

Even after moving out, she continued helping them financially and said she planned to do so for as long as possible, to give back the support she had received growing up.

But even in the US, where individualism often takes center stage, the idea of helping parents isn’t unusual.

According to a survey by GOBankingRates, 13% of children said they plan to fully support their parents in retirement, 12% said they’d cover most of their parents’ expenses, 39% said they’d help as needed, and 37% said they don’t plan to provide any financial support at all. Interestingly, 92% of parents polled said they don’t expect any financial help from their kids.

“Most people in the United States are independent, and they don’t want to rely on anybody,” explained Kathleen Hastings, a certified financial planner with FBB Capital Partners in Washington, D.C.

Experts agree that the conversation should always start with your own financial reality. “Helping your parents is one of the most noble things you can do,” said Cheryl Kirsten, a senior wealth planner with SunTrust Bank. But, she stressed, it should never come at the cost of your own financial stability.

Age also plays a role. The survey found younger generations are more cautious, often prioritizing their own security before committing to support aging parents.

So what’s the best path forward? Open, honest conversations. Experts advise parents to communicate their financial plans with their children before it becomes urgent.

“You need to talk about these things before you can’t,” Hastings said. Without that transparency, children may not have the information or resources to step in when needed.

Unfortunately, many families avoid these talks. “Parents generally want to keep their finances secret,” Kirsten admitted. This was true in her own life, but she managed to open the conversation by framing it around wanting to understand her parents’ wishes.

If your parents hesitate, there are gentle ways to approach the subject. You might mention you’re thinking about retirement savings or writing a will and then ask how they’ve handled those things, Kirsten suggested.

Or, as Michael Kay, a certified financial planner and president of Financial Life Focus in Livingston, NJ, recommended: bring up a story you heard about a family struggling because parents hadn’t planned, then ask, “How could we avoid that problem?”

You could also ask directly what you’d need to do if something ever happened to them, making it clear the question comes from concern, not judgment.

The earlier these conversations happen, the better. That way, if your parents will eventually need support, you’ll have time to adjust your budget or prepare your assets.

At the end of the day, whether children should financially support their parents depends on many factors—your own circumstances, your parents’ situation, your relationship with them, and your cultural values. But one thing is clear: communication matters. Talking honestly about expectations can prevent a lot of misunderstandings and resentment down the road.

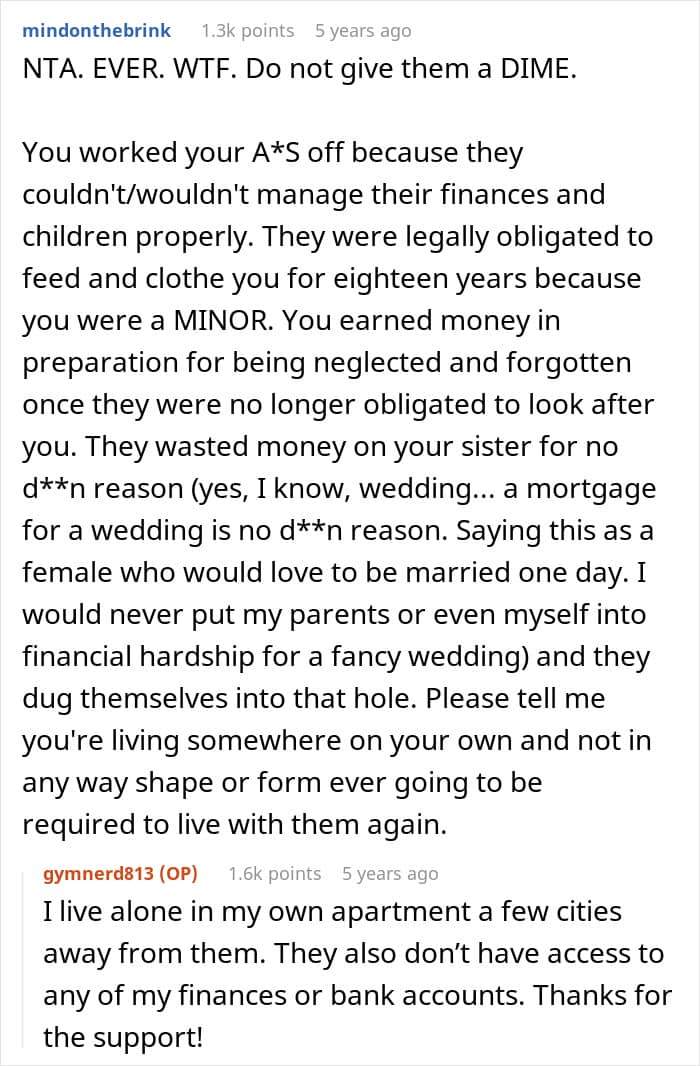

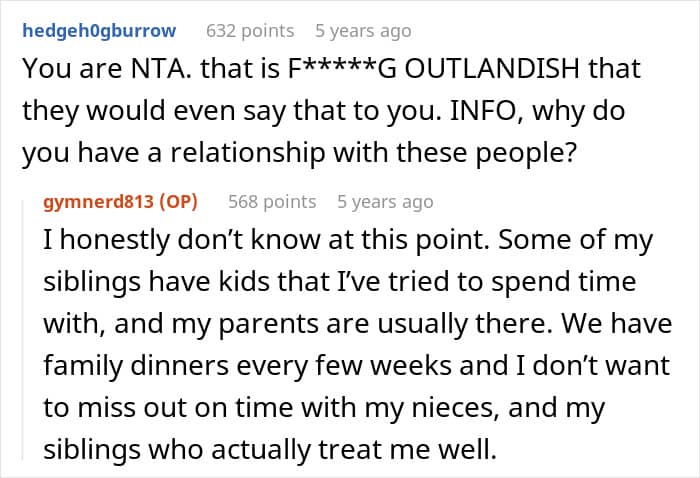

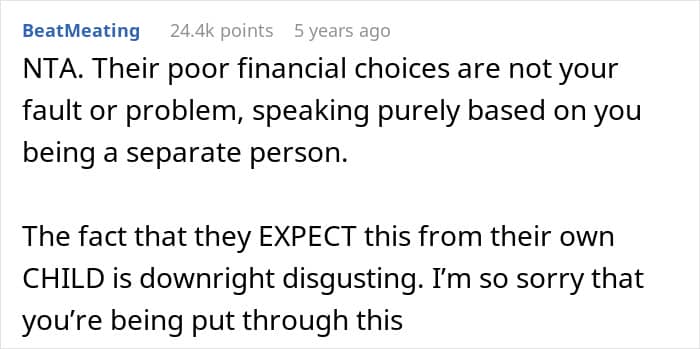

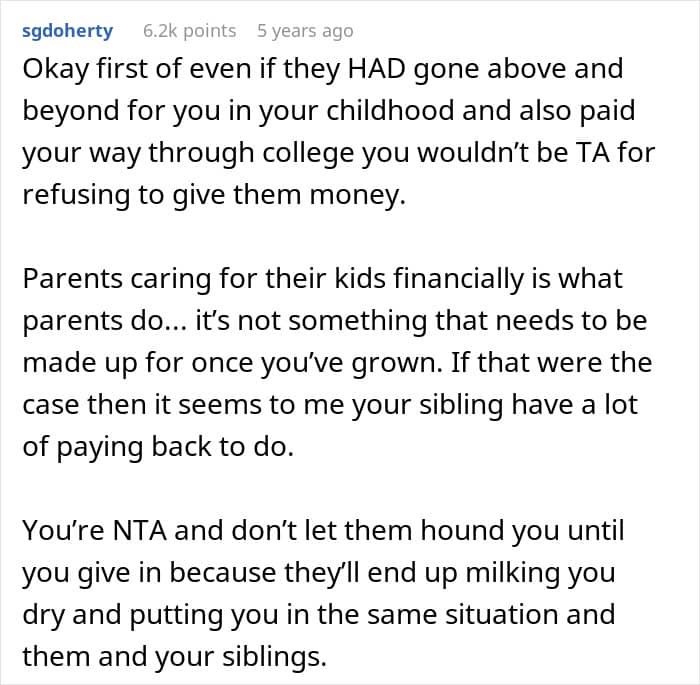

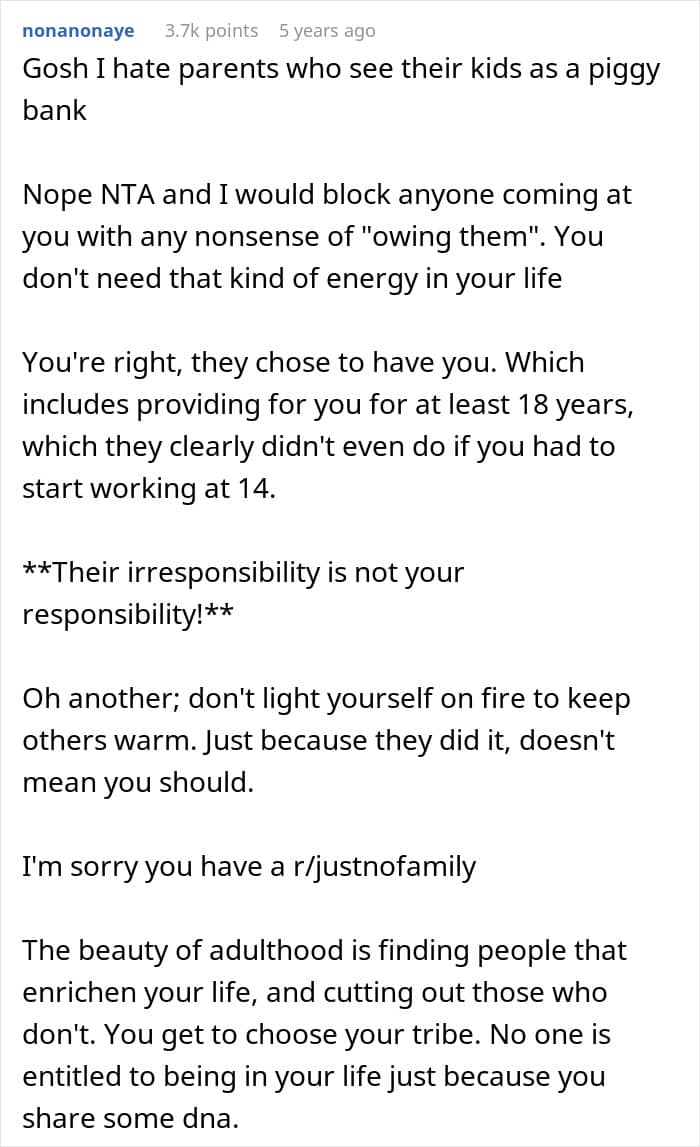

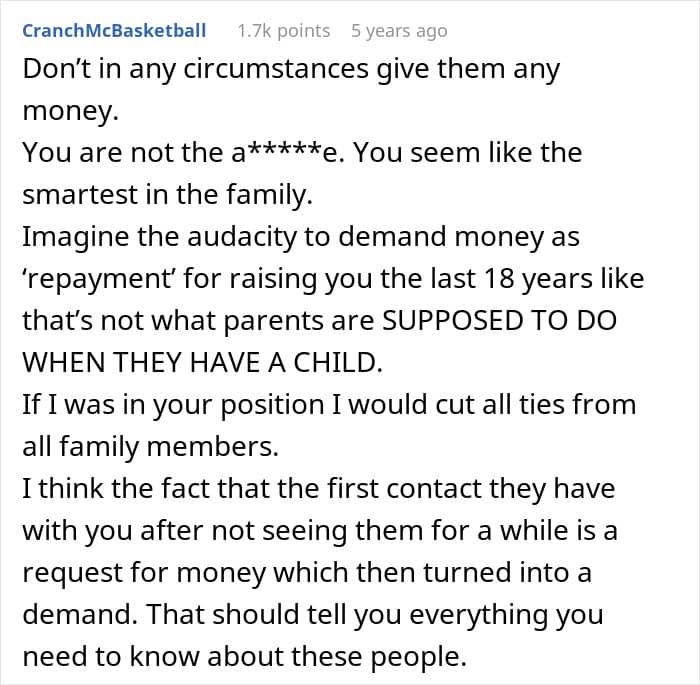

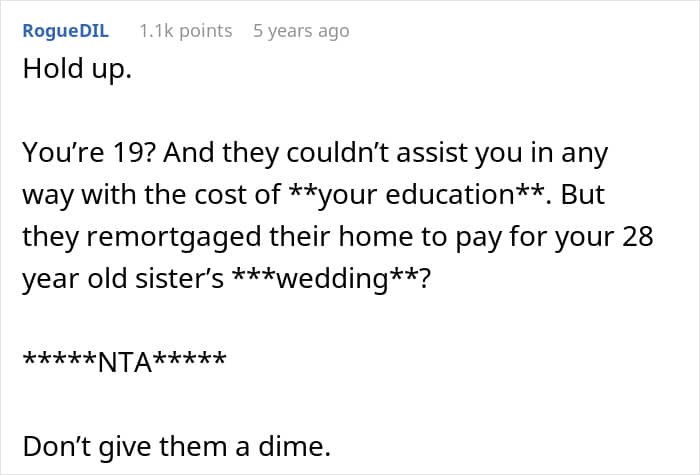

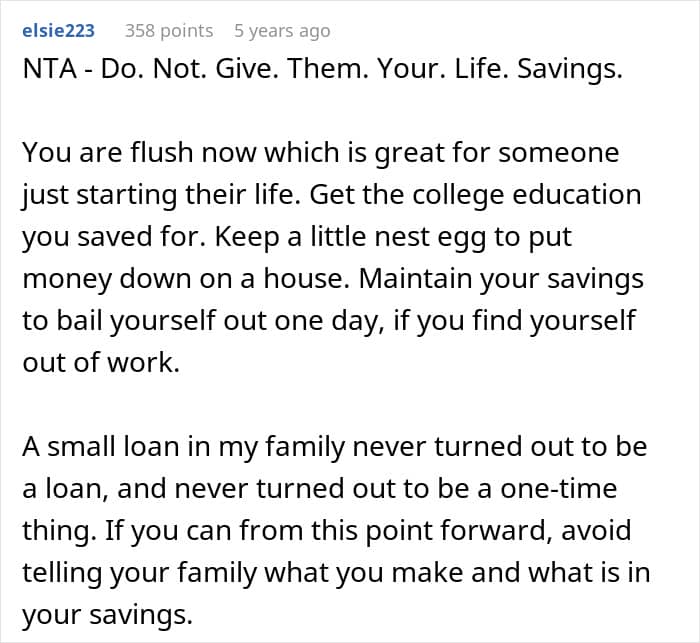

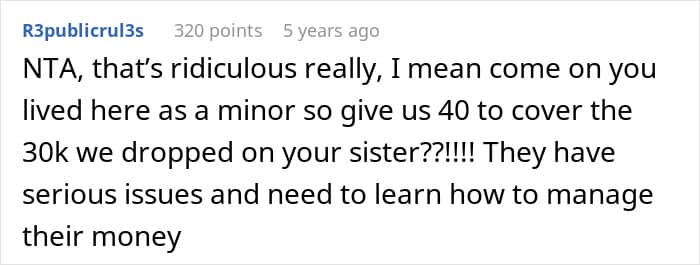

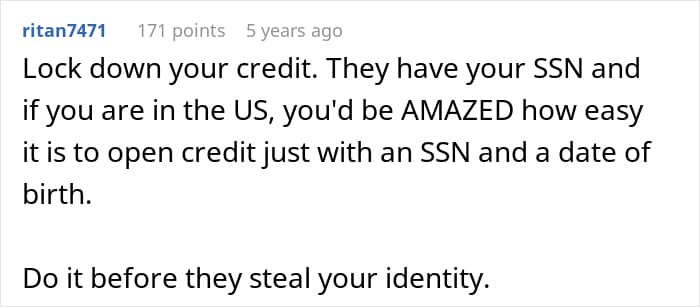

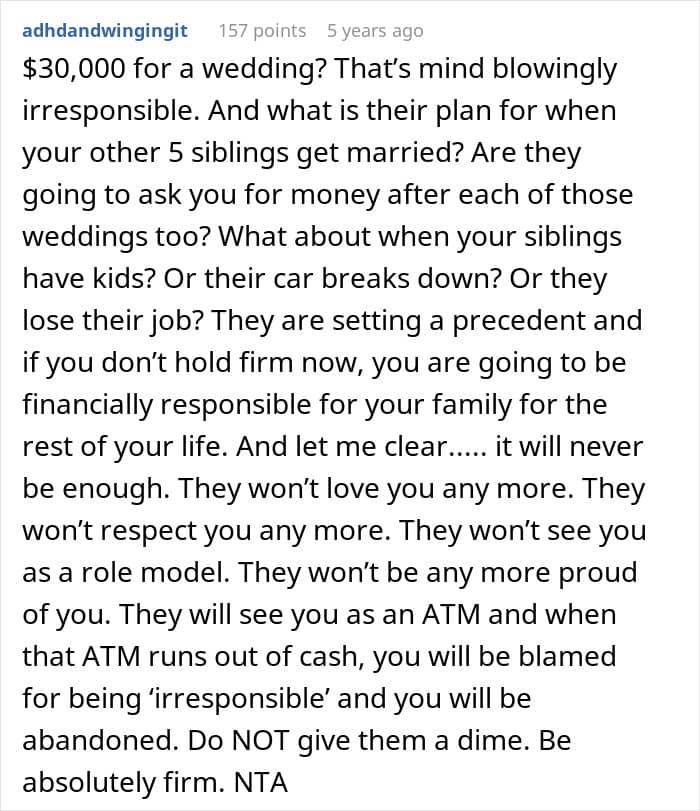

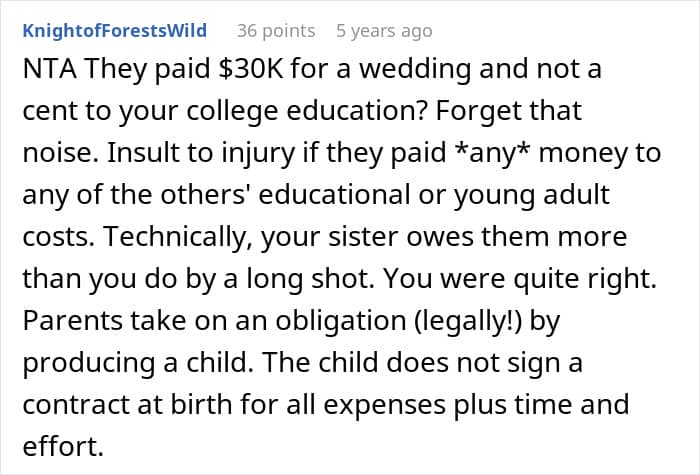

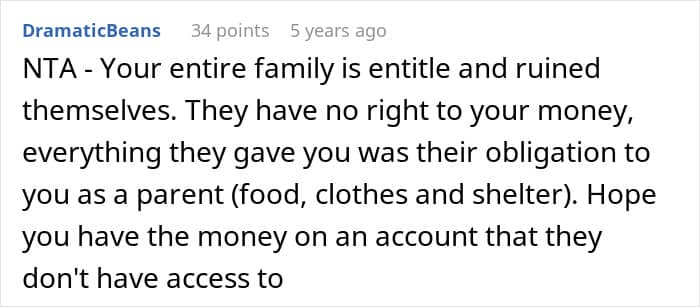

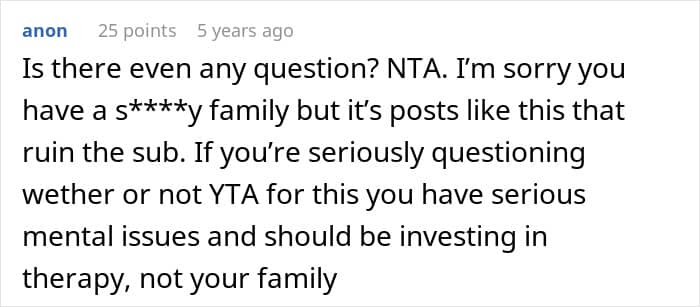

Readers were just as surprised and encouraged the author to hold on to her hard-earned savings